Will Your California Property Tax Skyrocket in 2020?

Summary

For the first time in over 40 years, annual tax rates for business owners could become unguarded to dramatic increases. Until now, Proposition 13 has held Government collection at bay by allowing a maximum tax payment of only 2% increases from the previous year. Approved by voters in June of 1978, Proposition 13 limits a property's assessed value to the year it was purchased. Subsequent tax increases are always based off the initial purchase year, regardless of current market values.

For example, if you had purchased a distressed property in 2009 for $500,000, your tax rate would not change from that base year value even though your same property is now worth $1,000,000 in 2019.

Currently, a reassessment for a new property tax rate only occurs upon transfer of title. There a few exclusions, including allowing for heirs and spouses to take control of real properties without a change to the annual property tax.

This could all be changing come November 2020. The State of California will see a "split roll" ballot initiative, potentially removing protections on commercial properties while leaving residential real estate still covered by Proposition 13.

If passed by voters, current commercial property tax bills would be adjusted to reflect current market real estate values. After this initial change, local governments would then readjust the tax assessed at least once every three years. The Legislative Analyst's Office has projected an annual revenue increase of $6.5 billion to $10.5 billion. These funds would be distributed between county assessors, the state General Fund, local governmental districts, cities, and counties. Approximately 40% of the remaining new revenue would then go to educational facilities in the state, such as public schools and community colleges.

Avoidance

Looking ahead, if an approved split roll Proposition 13 passed, there would be some remaining grace for those individuals and companies that met specific criteria. Commercial property owners with business real estate holdings of less than $2 million or companies with 50 or fewer full-time employees would be exempt. All owned business locations would count toward the $2 million cap. The property owner's company also is required to operate on a majority of the property while meeting the above requirements. If a tenant were to share part of the building that resulted in greater than 51% occupancy, tax reassessment would occur and protected status would be lost.

Investors and Tenants

Because of the rule of majority occupancy, individuals that own commercial space for investment purposes would be ineligible to qualify for exemption even though their property value may be under the $2 million limit. The result would be a significant cut to investors' cash flows depending on when their properties were obtained. The greatest personal impact would be to retirement-age individuals who have investment property set up for income purposes. As the equity in South Orange County has skyrocketed over the last few decades, major costs would be added to annual operating expenses.

Once investors feel this squeeze from the tax collectors, we would expect to see those increases passed through to business tenants. Watch for rent increases, extra charges for supplemental taxes upon renewal, and depending on the lease structure, direct tax payments from the tenants. In many leases, the occupying tenant is required to pay all property tax. In these scenarios, the investor would still have the same income from rent, while the Lessee writes a check straight to the tax office.

To stay in business, these companies would then have to raise the prices for their goods and services to the consumer. In the end, a massive increase across the combined commercial industries in California would find its way to the bank accounts of customers.

Going, Going, Gone?

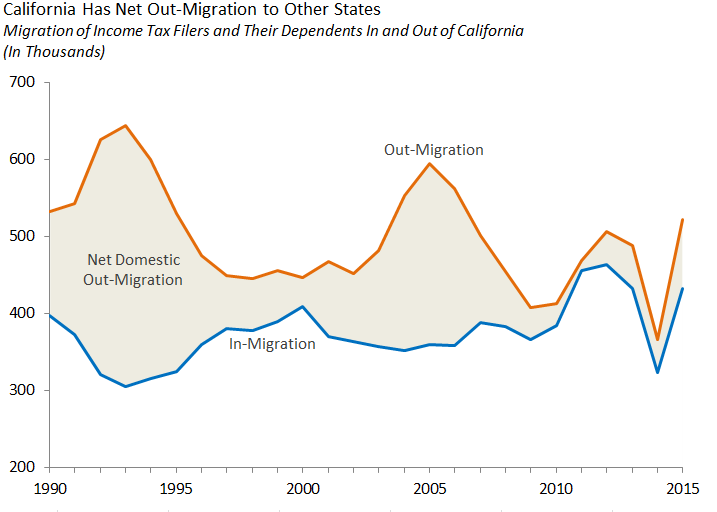

Currently, California already has a negative migration rate, with an exodus of residents leaving for other states in the nation. Between 2007 and 2016, the Golden State had a net loss of 1,000,000 people to domestic relocation. 6 million people left while 5 million moved into the state during that same period. That's an approximate negative outflow of 2.5% of the state's entire population.

Open speculation is allowed for what the next net migration chart will show depending on the outcome of this split roll measure.

Battlegrounds

An interesting reflection on this current situation is to look at some of California's largest and oldest companies. Mega-corporations such as Disney(land), major sports teams, thousand-acre ski resorts, and household-name technology campuses are still charged property tax rates from a time before the CD-ROM was invented (1985). Disneyland pays a tax rate based on a 1970's valuation. Proponents of a change point to the perceived unfairness of these companies growing international empires without the same rate of payment increase for their local hometowns.

Lenny Goldberg, executive director for the California Tax Reform Association, told the Los Angeles Times, "That’s a ridiculous, outdated, irrational system which causes damage in many different ways. We have this huge hole in the heart of our tax system. How long should we allow commercial properties to be assessed at 1975 values, costing local governments and schools billions of dollars?"

Another problem would be the sheer human-hours needed to reassess millions of commercial square feet. Heavy metro areas like San Francisco and Los Angeles County would be especially strained to assess and collect monies based on the new sales price values.

“...there are no tweaks or amendments that can be made to this split roll measure that will prevent it from being a major, multi-billion-dollar tax on all Californians in the form of higher prices on everything we buy – from groceries and gasoline to diapers and daycare...," stated Prop 13 opponent Rob Lapsley in an online press release. Lapsley is the co-chair of Californians to Stop Higher Property Taxes and president of the California Business Roundtable.

Panic, Plan, Pray?

Before pulling out your property tax calculator, moving boxes, or champagne (depending on your preferred voting outcome), remember that there are still approximately 15 months before a potential change. It is important to consider the two possible results. Make a rough financial plan of what your annual budget might look like either way. This measure could affect a sweeping portion of California business owners. Remember, even if you are a tenant, property tax increases can be passed to you through the landlord.

How do I stay exempt?

If you own the commercial real estate your business operates from:

Occupy 51% or more of your total building space.

Employee 50 or less full-time employees.

Have a total combined commercial property value of under $2,000,000 (between all locations).

Avoid any transfers of property title between entities or people.

If you are a tenant renting the commercial real estate your business operates from:

Check your current lease terms for pass-through expenses.

Look if the total tax increase amount is limited to a maximum cost for the length of your lease.

Talk to your landlord about future options should they receive a major reassessment.

If you are an investor using commercial space for income:

At this time, the only way to stay exempt would be to meet the criteria from the owner-operator section above.

Talk to your tenants about future contingencies for both parties.

Sharing

Now that you're armed with the facts and knowledge you need to know, go out and make the best decision possible when November 2020 arrives.

Send us an email with your thoughts on this impending vote: contact@wynnecre.com.

Thanks for reading to the bottom. You must like what you see, so bookmark our website in your browser, share this article with your business friends, and follow us on social media using the buttons below.

Content created by Jim Wynne’s Team at Kidder Mathews: Orange County Commercial Real Estate Experts.